By: Kevin-Barry Henry, #1 Bestselling Author

Gifting a life insurance policy to a favorite charity has many benefits both for the charity and for your chosen beneficiaries.

A life insurance policy as a gift can be an appealing option for any prospective donor and an important component of their overall charitable giving strategy. The two most frequently used methods for donating to charities through life insurance:

- Donating a life insurance policy while living

- Donating the proceeds upon death

Let’s take a look at both strategies.

Strategy #1: Donating a life insurance policy while living

A person makes a charitable donation of investment funds and uses the tax savings to fund an insurance policy.

Gifts-in-kind are becoming increasingly popular among charitable donors. In this case, the charity does not receive “cash” donations, but rather another tangible asset. Gifts of capital property to a charity are typically deemed to be disposed of at fair market value (FMV) for tax purposes, with 50% of the gain taxable to the donor.

Under certain conditions, gifts in kind are eligible for special tax treatment under CRA guidelines. CRA has made it easier for individuals (and corporations) to donate to charities over the last 20 years by instituting a zero-percentage-point capital gains inclusion rate on the following types of eligible capital property:

- Stocks, bonds, and other publicly traded securities

- Shares in a mutual fund corporation

- Units in a mutual fund trust and

- Guaranteed investment funds (our favorite)

- Certified Canadian Cultural or Ecological Property (*items of “outstanding significance and national importance” and would include art and historical artifacts)

A zero-percentage capital gains inclusion rate means that no capital gains, if any, are included in the donor’s taxable income as a result of the gift.

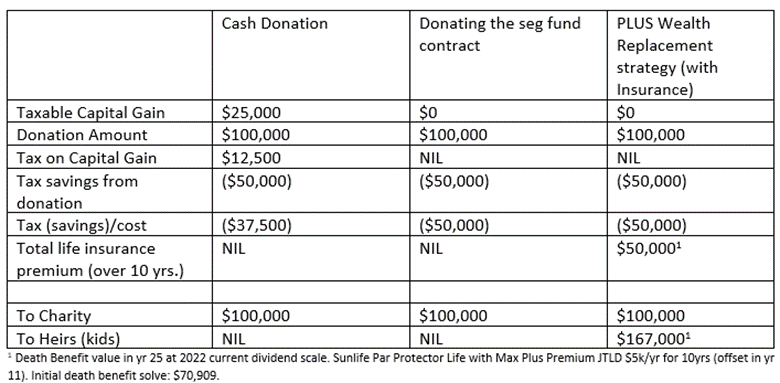

Consider the following example (see chart below):

Jessica and Bill (60 n/s) want to give $100,000 to their favorite charity. They have a segregated fund portfolio with an FMV of $100,000 and an ACB of $50,000. They’re in a 50% marginal tax bracket and make enough income to be able to claim the full amount of the donation receipt in the year that it’s made.

The first column shows what would happen if they sold the investment and donated the proceeds. The second column shows the outcome of simply donating the Guaranteed Investment Fund (in-kind) to the charity. In the end, they would save $12,500 in taxes by donating the guaranteed investment fund portfolio rather than cash.

We can go a step further and implement a “wealth replacement” strategy (third column). If the couple also wants to leave something for their heirs and mitigate the estate erosion caused by the gifting of the guaranteed investment fund to charity, they could use the tax savings from the donation tax credit to fund a life insurance policy. The estate will be replenished by the life insurance policy.

Let’s assume, for the sake of simplicity, that the charity receives a portion of the guaranteed investment fund portfolio each year for ten years ($10,000 each year for ten years) rather than a one-time donation. The tax receipt generated equals $10,000 per year, resulting in a $5,000 tax savings per year. These tax breaks will be used to pay for a life insurance policy.

At year 25 (age 85), the charity would have received $100,000 in donations over ten years, and Jessica and Bill’s estate is replenished with approximately $167,000 in insurance proceeds and a residual balance (nominal value) from the segregated fund portfolio.

Strategy #2: Donating the proceeds upon death

A person expects to own registered assets (RRSP/RRIF) at their death.

Another common strategy is for a client to expect to own registered assets (RRSP/RRIF) at death. In this case, they will almost certainly have a significant tax liability that can be avoided by donating those assets to charity.

The FMV of investments held within registered plans (RRSP/RRIF) is included in the individual’s income in the year of death unless a spouse or eligible dependent can rollover.

Let’s look at another example:

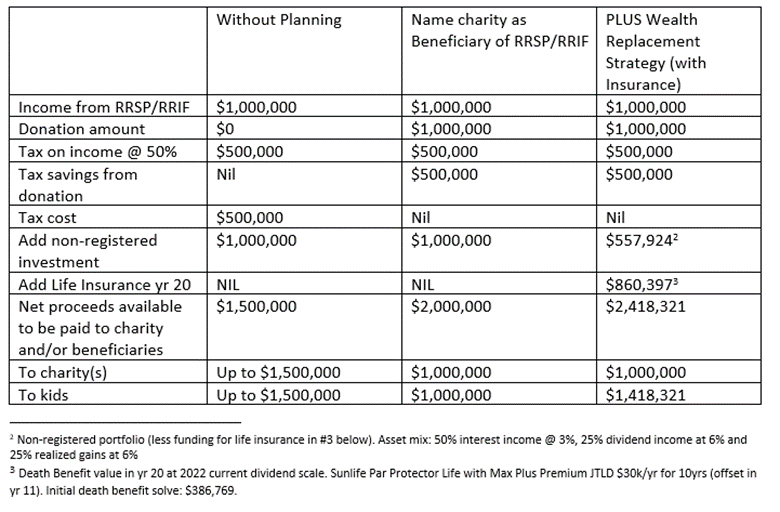

Jerry and Tiffany Smith are both 65 years old and have a sizable registered (RRSP/RRIF) portfolio valued at $1,000,000 at life expectancy (age 85 or year 20). They also have a non-registered portfolio, which is expected to be worth $1,000,000 and is mostly comprised of tax-paid assets. Their three children are the registered account and estate beneficiaries. At death, their marginal tax rate is 50%.

Without planning (first column), the Smiths will have $1.5 million to distribute among their children and charities if they so desire. If they name a charity (or charities) as a beneficiary (second column) of the registered portfolio (RRSP/RRIF), $1 million will be donated to the charity and $1 million will be divided among the children. If they incorporate a “wealth replacement strategy” using permanent life insurance (third column), they can enhance their gift to their kids by roughly $400k (or more to the charity if desired).

Without planning (first column), the Smiths will have $1.5 million to distribute among their children and charities if they so desire. If they name a charity (or charities) as a beneficiary (second column) of the registered portfolio (RRSP/RRIF), $1 million will be donated to the charity and $1 million will be divided among the children. If they incorporate a “wealth replacement strategy” using permanent life insurance (third column), they can enhance their gift to their kids by roughly $400k (or more to the charity if desired).

Charitable giving with life insurance can include strategies in which a charity receives non-insurance assets while the donor’s estate receives insurance proceeds. The two estate replacement strategies discussed in this article show how a donor can maximize (or stretch) their existing wealth to increase their gifts to both charities and foundations.

In addition to the donation tax credit, charities and/or heirs can benefit from a variety of tax breaks.

Life insurance is the swiss army knife of estate planning. It is simply the most useful and elegant answer to so many estate planning questions that begin with “How can I…?”

Talk to the KBH Financial advanced case team today by booking a FREE 15-MINUTE CALL

With Gratitude,

KB.

THIS ARTICLE IS PROVIDED AS A GENERAL SOURCE OF INFORMATION ONLY AND SHOULD NOT BE CONSIDERED TO BE PERSONAL INVESTMENT OR LEGAL ADVICE. READERS SHOULD CONSULT WITH THEIR FINANCIAL OR LEGAL ADVISOR TO ENSURE IT IS SUITABLE FOR THEIR CIRCUMSTANCES.